Quant Valuation & Risk Services

Valuation, Risk and Regulatory. For All Asset Classes

Quantitative services developed together with Tier 1 and Tier 2 financial institutions

- Valuation & Risk: Coverage of all asset classes and a very high number of instrument types

- IAS39 compliant platform: including valuation, market conformity checks, best execution and cost analysis

- Full service PRIIPs Platform: incl. document generation and calculations for all instrument types and categories (KIDs, Factsheets, PIBs, etc.)

- Regulatory document hub: Designed for compliance and efficient distribution of regulatory documents

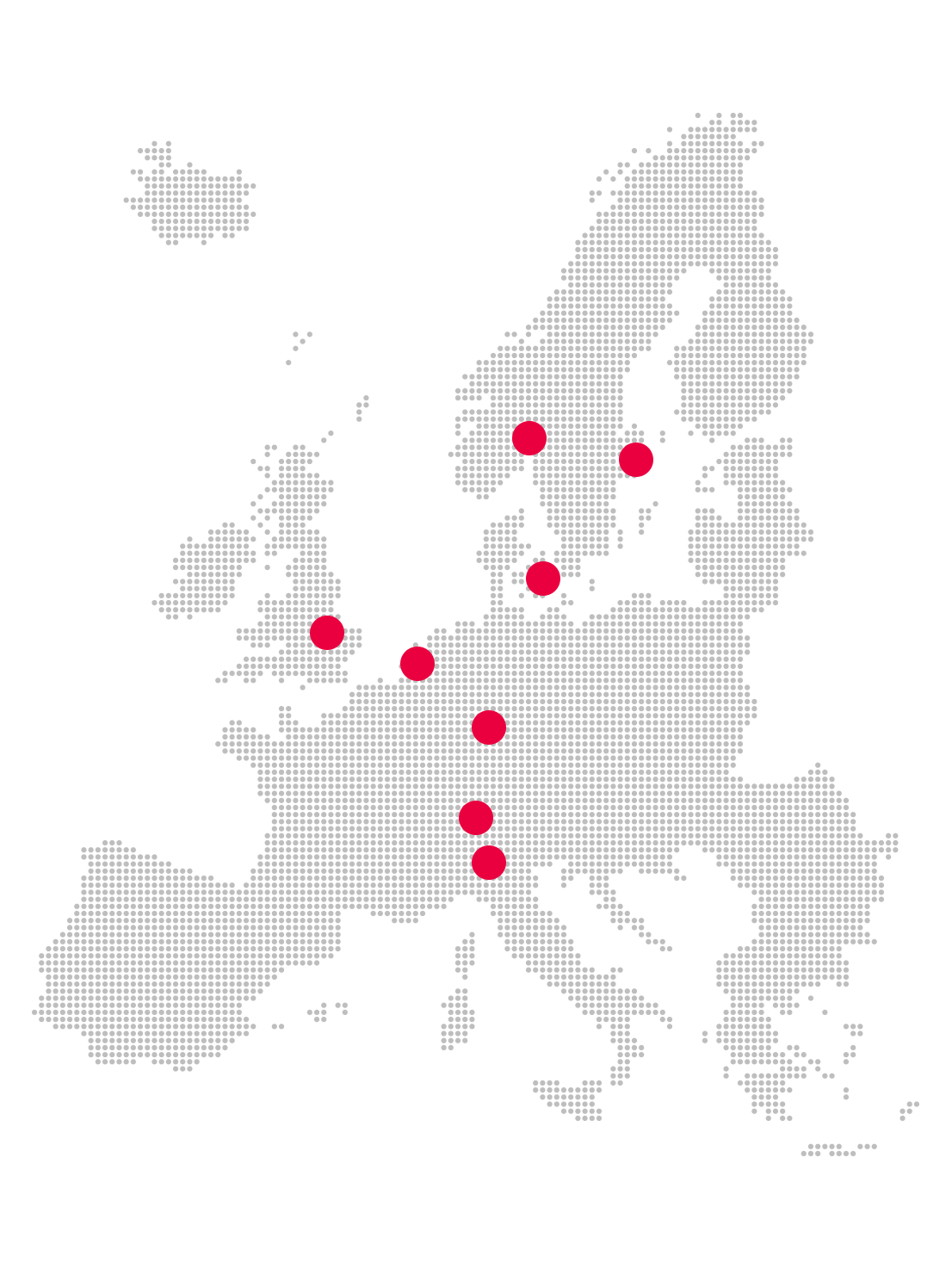

Serving our pan-European client base

1000+

Instrument types

20+ Billion

Risk scenarios per day

1+ Million

Fair value calculations per day

What sets us apart

Our quant services for banks, insurers, pension funds, issuers, asset, and wealth managers rely on our unique strengths

Tier 1-Level excellence to all

We serve leading clients across Europe, helping them to optimise returns, manage risk and comply with reporting requirements in a complex regulatory landscape.

From tier 1 giants to innovators

We serve 70+ large institutional clients and are extending our services to include tier-2 innovators

Big players

We collaborate with the largest institutional players with advanced quantitative services for sophisticated valuation, risk management and global market strategy enhancement, crucial for maintaining their competitive edge and regulatory compliance.

Innovators

We use our many years of quantitative experience and the scalability of our digital infrastructure to leverage our know how and provide a cost-effective and standardized service to smaller institutions.

All assets classes. All products

We provide unparalleled coverage of asset classes, encompassing a diverse range of instruments

-

Structured (multi-asset) products/certificates

-

Plain derivatives

-

Exotic and OTC derivatives

-

Fixed Income (straight, indexed, structured)

-

Structured finance (ABS, CDO, CLO, etc.) incl. subtypes repackaged securities in SPVs

-

Loans and funds

-

Infrastructure and reals estate projects

-

Index calculations

-

Insurance contracts

-

Special and new valuation classes

Valuation and Risk calculation services

- Wide Product Coverage: Comprehensive valuation and risk services for a wide range of financial products, ensuring holistic portfolio analysis and informed decision-making

- Comprehensive Set of Key Figures: Standardized financial key figures and sensitivities as well as customized financial metrics tailored to each client's specific objectives and risk tolerance, enabling focused and relevant instrument and portfolio insights

- Transparent Calculations: Clear and well-documented methodology concepts for all valuations and risk assessments, with accessible data and assumptions for client review and confidence

- Portfolio Calculations: Advanced, multi-dimensional portfolio analysis to assess and manage various risk factors, optimizing investment strategies and achieving financial goals

IAS39-compliant determination of valuation prices

IAS39-compliant determination of valuation prices

-

Multi-Service Platform: Evaluates transaction, position, and cost data, ensuring compliance with both local and international standards

-

Daily Valuation Prices: Automated determination of fair values for bank and fund portfolios, aligned with IAS39 regulation

-

Product Coverage: Includes both liquid and illiquid (OTC) products

-

Automated & Scalable: Designed for seamless regulatory compliance

Simplify Your Regulatory Compliance

Process-reliable template creation, workflow-supported administration, regulatory-compliant key figure calculation and automated distribution.

Template Manager enables the simple creation and administration of regulatory documents such as product information sheets (PIBs), basic information sheets (PRIIP-KIDs) or the creation of termsheets, factsheets and all documents relating to your individual products and their presentation.

-

Comprehensive Modular Solution: Includes all necessary elements and calculations for PRIIPs regulation compliant KIDs. It covers all Regulatory Technical Standards (RTS) - relevant product categories for banks, funds and insurance companies

-

Customizable & Scalable: From SaaS with adaptable workflows to a full-service platform, ensuring cost savings

-

Efficient Workflow Engine: Custom-configurable for specific client needs, enhancing data and document distribution

Easy access to regulatory documents

Document Hub is our comprehensive, modular service offering for the distribution, procurement and archiving of regulatory documents.

- Information sheet (PIB) within the meaning of § 64 para. 2 WpHG for shares and bonds, with the corresponding metadata

- Basic information sheet according to PRIIP regulation (PRIIP-KID) as original PDF document from issuers, fund providers and derivatives and futures exchanges with relevant metadata and version history

- Basic information sheet according to FIDLEG (BIB) for the investment and securities business in Switzerland

- Fund documents and mandatory publications, such as key investor information (in accordance with UCITS & CISAs), original fact sheets, sales prospectuses and financial reports

- Metadata on target market and cost transparency as well as CEPT/EPT reporting of investment companies

- Identification of the target market for non-PRIIP relevant instruments

- Individual documents for investment advice such as fact sheets, product information, in-house opinions, research, etc.

Connect with our local experts

We are always ready to assist and guide you in maximizing the benefits of our tailored market data solutions.

Available in the following regions:

- Nordics

- UK

- Germany

- Switzerland

- Benelux

- Italy

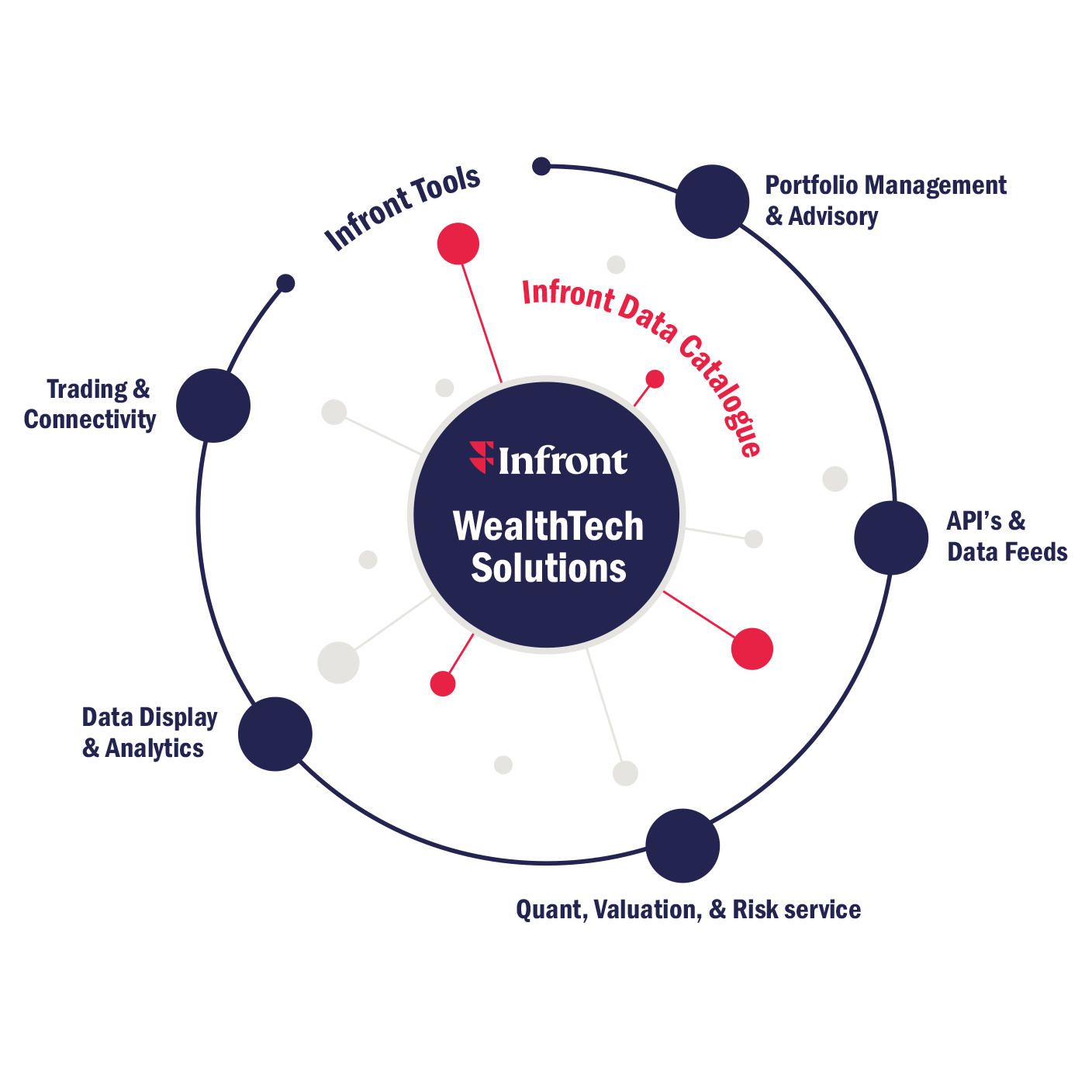

Part of the Infront ecosystem

Get access to our Quant services both directly from our team or through our range of tools and services:

-

Powerful data display and analytics solutions

-

Via our Portfolio Management and Advisory solutions

-

Configure and integrate data feeds to serve your needs on how to consume the calculations services